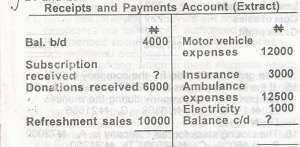

N2000

N1500

N1250

N1000

Correct answer is D

No explanation has been provided for this answer.

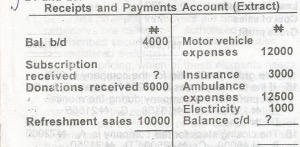

N30000

N28000

N24000

N20000

Correct answer is D

No explanation has been provided for this answer.

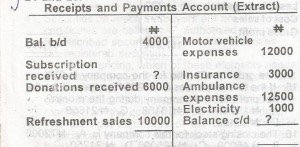

N11500

N12000

N13000

N13500

Correct answer is A

No explanation has been provided for this answer.

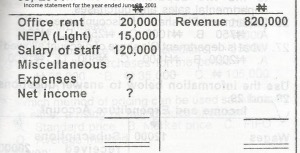

Miscellaneous expense is 10% of revenue Calculate the net income.

N583,000

N563,000

N483,000

N581,000

Correct answer is A

miscellaneous = 10% of 820,000

10/100×820,000 = 82,000

miscellaneous expense= 82,000

Expenses = office rent + nepa (light) + salary of staff + miscellaneous

20,000 + 15,000 + 120,000 + 82,000 = 237,000

net income = revenue - expenses

820,000 - 237,000 = 583000

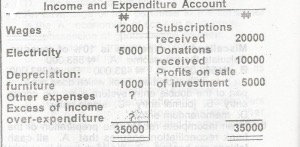

N12000

N15000

N10000

N14500

Correct answer is A

No explanation has been provided for this answer.

JAMB Subjects

Aptitude Tests