N1,310

N1,850

N1,990

N2,210

Correct answer is A

The insurance premium to be taken to the profit and loss account will be the amount which could not be recovered by the trader on account of credit sales. It is a business loss, so is debited in the profit and loss account.

Insurance premium posted to the P/L account would be;

710 + 600 = 1310

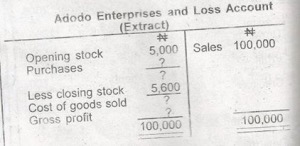

If the opening stock is 5% of sales. calculate the purchases

N95,600

N95,000

N90,600

N85,000

Correct answer is C

opening stock + cost of goods sold - closing stock = purchase

Remember COGS was given as;

cost of goods sold = sales - profit (10% of sales)

100,000 - 10,000 = 90,000

Hence we have;

purchase = 5,000 + 90000 - 5,600 = 90,600

If the gross profit margin is 10% of sales, what is the value of the cost of goods sold?

N10,000

N90,000

N105,600

N110,000

Correct answer is B

No explanation has been provided for this answer.

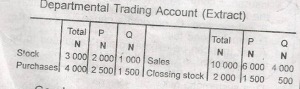

N5,200

N3,000

N2,800

N2,500

Correct answer is D

No explanation has been provided for this answer.

N2,500

N2,300

N2,200

N1,700

Correct answer is B

No explanation has been provided for this answer.

JAMB Subjects

Aptitude Tests