When Your Silence Is Loud..& Your Eyes Speaking Volumes..

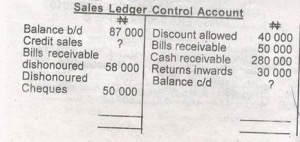

Calculate the value of credit sales.

N484,000

N448,000

N584,000

N558,000

Correct answer is B

160/100 x 280,000

1.6 x 280,000 = 448,000

credit sales = 448,000

Credit sales is given at 160% of cash received.

What is the balance c/d? debit 64300

N333,000

N234,000

N343,000

N243,000

Correct answer is D

Credit sales = 160% x 280,000 (cash receivable)

160/100 x 280,000

1.6 x 280,000 = 448,000

credit sales = 448,000

Bal c/d = debit side - credit side of the account. Hence we have;

Debit side = 87,000 + 488,000 + 58,000 + 50,000 = 643,000

credit side = 40,000 + 50,000 + 280,000 + 30,000 = 400,000

643,000 - 400,000 = 243,000

Bal c/d = 243,000

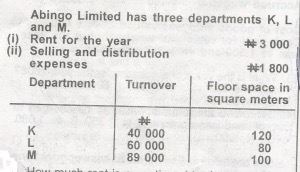

How much selling and distribution expenses is apportioned to department M?

N800

N600

N400

N1800

Correct answer is A

Department difference M has a turnover of 89,000. That is 29,000 higher than department L and 49,000 higher than department K, This means department M has the highest selling and distribution cost because they sold the most. Hence the 1800 would be divided amongst the three departments in the ratio of their turnover

Department K = 400

L = 600

M = 800

total = 1800

How much rent is apportioned to department K?

N1200

N1800

N2000

N750

Correct answer is A

Since department K has the biggest shop space, its only fair that it pays the bigger chunk of rent. Hence it would be shared amongst the three department as;

Department k = 1200

L = 800

M = 1000

Total = 3000

N1,710

N1,760

N2,000

N2,240

Correct answer is D

No explanation has been provided for this answer.

JAMB Subjects

Aptitude Tests