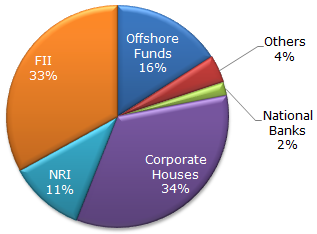

The following pie chart shows the amount of subscriptions generated for India Bonds from different categories of investors.

Subscriptions Generated for India Bonds

What is the approximate ratio of investment flows into India Bonds from NRI's to corporate houses ?

1:4

1:3

3:1

Cannot be determined

Correct answer is B

11:34 is approximately equal to 1:3

The following pie chart shows the amount of subscriptions generated for India Bonds from different categories of investors.

Subscriptions Generated for India Bonds

40 %

50 %

60 %

70 %

Correct answer is B

FII's currently account for 33 out of 100.

If their value is doubled and all other investments are kept constant then their new value would be 66 out of 133 = approximately equal to 50%

The following pie chart shows the amount of subscriptions generated for India Bonds from different categories of investors.

Subscriptions Generated for India Bonds

274,100

285,600

293,000

Cannot be determined

Correct answer is A

Investment other than NRI and corporate houses is 33% = 335000. Also, investment by offshore funds and NRI's is equal to 27%.

Hence, 27 x 335,000/33 = 274 090.909

The following pie chart shows the amount of subscriptions generated for India Bonds from different categories of investors.

Subscriptions Generated for India Bonds

What percentage of the total investment is coming from FII's and NRI's ?

33 %

11 %

44 %

22 %

Correct answer is C

(33 + 11) = 44

Aptitude Tests