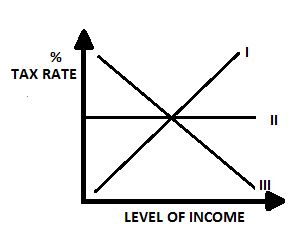

The curve labeled III illustrate a system of taxation

...

The curve labeled III illustrate a system of taxation

Regressive tax

Progressive tax

Value added tax

Proportional tax

Correct answer is A

A regressive tax falls as incomes increases while progressive tax rises as income increases. Proportional tax is a flat rate while value added tax is the tax imposed on goods and services at each stage of production.

Similar Questions

An important feature of perfect competition is that ...

Diminishing marginal utility implies that ...

A firm average cost decreases in the longrun because? ...

One of these is not a problem of agriculture___________ ...

From which of the following does Nigeria derive trade concessions? ...

A country would develop its agricultural sector first so as to ...