Advertising expenses incurred on a product in a business organization should be charged to

Sales department

Production department

Purchase department

Administration department

Correct answer is A

Advertising expenses are expenses incurred in order to enhance the sales of the company’s product/services

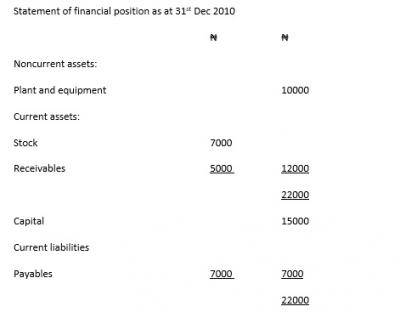

What is the amount of capital employed?

₦7,000

₦10,000

₦22,000

₦15,000

Correct answer is D

Capital Employed is the difference between the total assets and current liabilities of the company

When expenses are paid on behalf of the venture, the accounting entries is to debit

Bank account and credit joint venture account

Expenses account and credit bank account

Joint venture account and credit expenses account

Joint venture account and credit bank account

Correct answer is D

Joint venture account is an account that all expenditure incurred for the venture is debited and all income is credited to.

Debit joint venture and credit bank account because expenses incurred on behalf of the venture has to be debited to the joint venture account and since the money is joint out the bank must be credited to balance the account.

A part of public company's profits belonging to the shareholders is

Public issue

Bonus

Right issue

Dividends

Correct answer is D

Dividend is known as the kind of benefit enjoyed by the shareholder for investing their fund in a particular organisation.

An evidence of payment issued to a government ministry by a revenue collector is

Treasury receipt

Receipt voucher

Payment voucher

Treasury card

Correct answer is B

Receipt voucher is raised as evidence by revenue collector when government funds and property or received

Receipt voucher: these are vouchers raised as evidence for the receipt of government funds and property. The revenue collected is prepared for the government ministry as a means that revenue has been collected

JAMB Subjects

Aptitude Tests